Sedona Real Estate Market Summary (Through April 25, 2025)

Sedona Real Estate Market Summary (Through April 25, 2025)

📈 SINGLE FAMILY HOMES

YOY Performance:

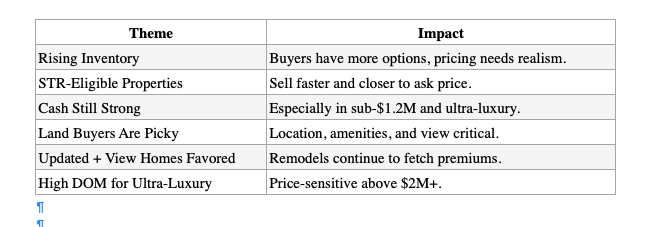

Price Correction: 6% softening in sale prices while transaction volume slightly rose.

Buyer Selectiveness: Buyers are showing up — but want fair pricing, strong views, or updated/remodeled homes.

Detailed Activity:

Cash vs Financed: 55% cash purchases; cash more dominant under $1.2M and over $2M.

DOM: Median 55 days / Average 79 days — faster than late 2024.

Price Reductions: 65% of sold homes had at least one price reduction.

Sold at Original List Price: 14% of sales matched original list price (mostly under $900K).

Sold Over Asking: Only homes under $900K (STR or turnkey properties) went over list.

Price Per Sq Ft: Holding in Uptown and West Sedona; softening in VOC and Big Park for larger homes.

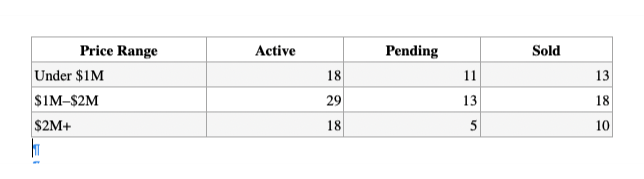

Price Bracket Breakdown:

1–2M Range: Most competitive tier; heavy price reductions before pending.

2M+ Range: High DOM, price corrections of $200K–$400K before sales.

VACANT LAND

YOY Performance:

Volume Down, Prices Up: Fewer land parcels are moving, but buyers are paying more per property.

Absorption Slower: Land buyers are choosier; properties with views and amenities are outperforming.

Detailed Activity:

Uptown Sedona: Strong land market (+100% sales YOY, avg price +36%).

West Sedona: Sales and prices up (+81% avg price increase).

Little Horse Park & VOC: Sluggish; steep sales decline (-57% in Little Horse, no sales in VOC).

Big Park: Prices dropped 40% even though units sold held steady.

Key Market Themes:

Categories

Recent Posts